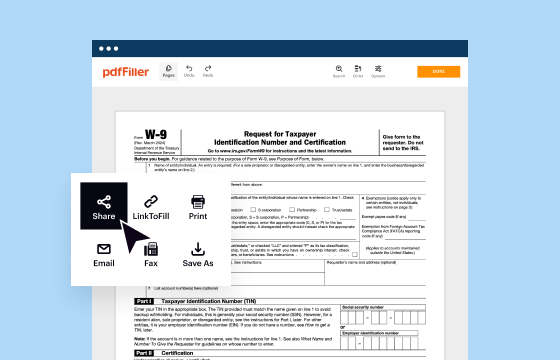

IRS 1040-A 2017-2025 free printable template

Show details

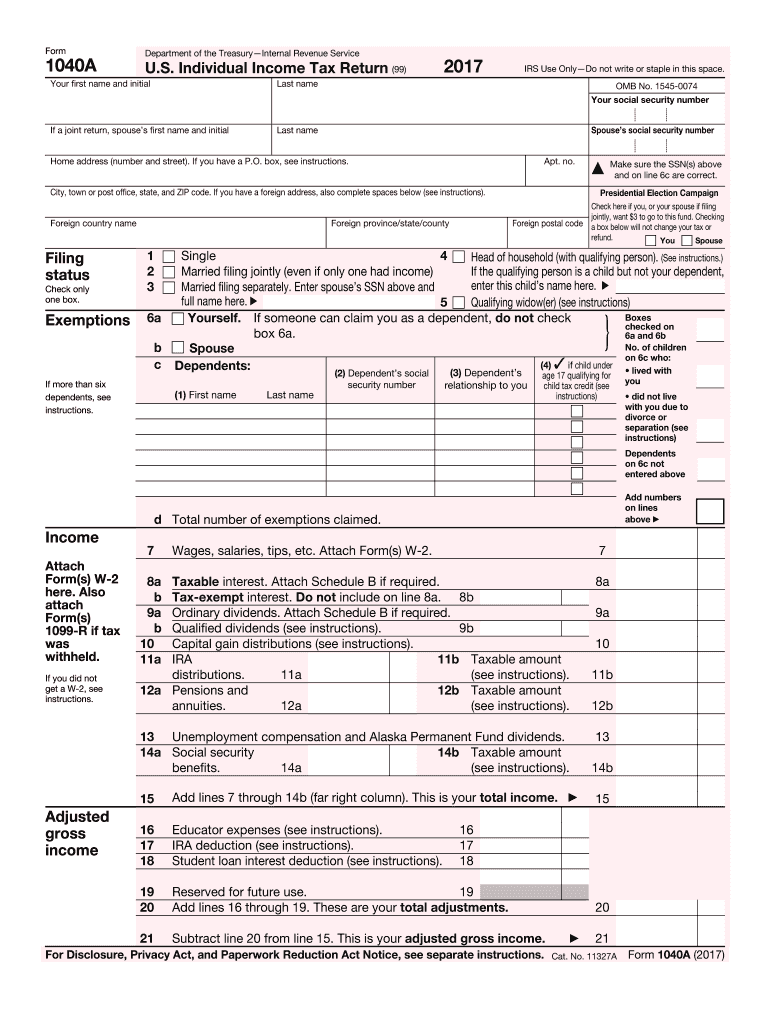

Form1040ADepartment of the TreasuryInternal Revenue Service. S. Individual Income Tax Return (99)2017IRS Use Only not write or staple in this space. Your first name and initially name OMB No. 15450074

Your

pdfFiller is not affiliated with IRS

Mastering the IRS 1040-A: A Comprehensive Guide

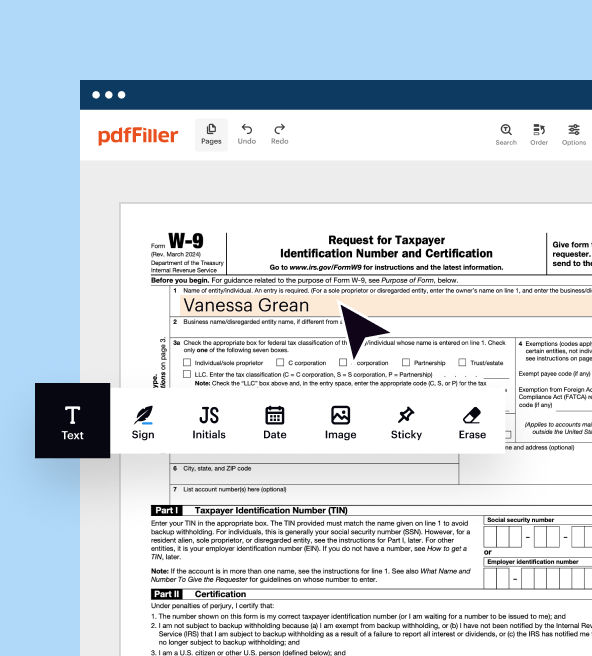

Detailed Steps to Modify Your IRS 1040-A Form

Essential Instructions for Completing the IRS 1040-A

Mastering the IRS 1040-A: A Comprehensive Guide

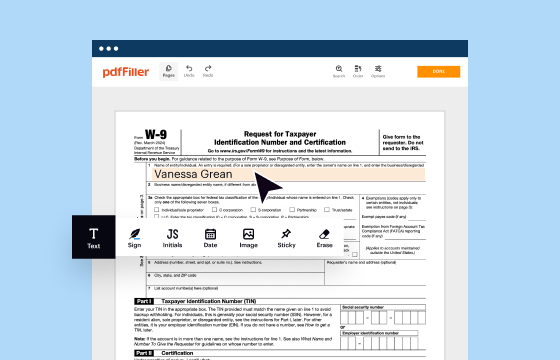

The IRS 1040-A form is a streamlined version of the standard 1040 tax return, designed for taxpayers who meet specific criteria. It simplifies the tax filing process for those with straightforward financial situations while offering a range of benefits, such as faster processing times and simplified deductions. Understanding how to utilize and navigate the 1040-A can lead to smoother tax filing experiences and ensure compliance with IRS regulations.

Detailed Steps to Modify Your IRS 1040-A Form

01

Review your previous year's tax return for data continuity.

02

Collect necessary documents, including W-2s, 1099s, and other income statements.

03

Identify and list all applicable deductions and credits to maximize your refund.

04

Access the most current version of IRS 1040-A from the IRS website or tax software.

05

Fill in your personal information accurately at the beginning of the form.

06

Enter your income details in the designated sections, ensuring no amounts are omitted.

07

Double-check the total income section and enter the appropriate adjusted gross income.

08

Apply any deductions or credits you qualify for, following the instructions closely.

09

Review your entries for accuracy and completeness before submitting.

10

Make a copy of your completed form for your records.

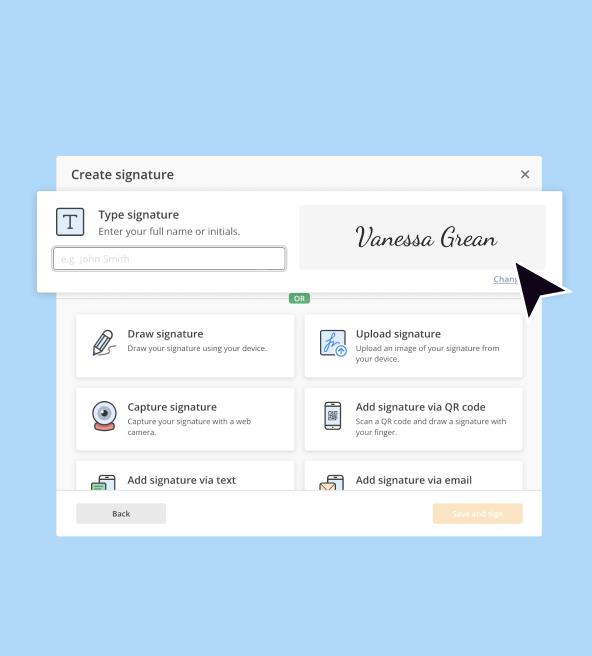

Essential Instructions for Completing the IRS 1040-A

01

The form requires basic identification details, including name, address, and Social Security number.

02

Report all sources of income: wages, interest, dividends, and retirement distributions.

03

Specify your eligibility for above-the-line deductions, such as student loan interest and tuition fees.

04

Utilize the tax tables provided in the form's instructions to determine your tax liability.

05

Sign and date the return to ensure its validity before submission.

Show more

Show less

Recent Changes and Modifications to IRS 1040-A

Recent Changes and Modifications to IRS 1040-A

Stay informed about the latest modifications to the IRS 1040-A, such as increased income thresholds for eligibility and amendments to commonly claimed deductions. For the tax year 2023, the standard deduction amounts have risen, allowing taxpayers to reduce taxable income more effectively. Review the IRS announcements for any new forms required or changes to the filing process that may impact your submission.

Key Information Regarding IRS 1040-A: Its Purpose and Utilization

Understanding IRS 1040-A

The Functionality of IRS 1040-A

Who Should Use IRS 1040-A?

Understanding Exemptions for IRS 1040-A

Filing Deadline for IRS 1040-A

Comparing IRS 1040-A with Other Tax Forms

Transactions Covered by IRS 1040-A

Required Copies for Submission

Penalties for Non-Submission of IRS 1040-A

Information Required for Filing IRS 1040-A

Additional Forms Needed with IRS 1040-A

Where to Submit Your IRS 1040-A

Key Information Regarding IRS 1040-A: Its Purpose and Utilization

Understanding IRS 1040-A

The IRS 1040-A form simplifies tax filing for individuals with uncomplicated financial situations. It offers an easier format for reporting income and claiming adjustments compared to the standard 1040 form, making it suitable for a wide range of taxpayers.

The Functionality of IRS 1040-A

The primary purpose of the IRS 1040-A is to provide a straightforward method for individuals to report their income and claim deductions. It is specifically designed for taxpayers who have a taxable income under certain limits and do not need to itemize deductions, thus reducing the complexity of the tax return process.

Who Should Use IRS 1040-A?

The form is ideal for taxpayers whose gross income does not exceed $100,000, who do not itemize deductions, and who have income from wages, pensions, interest, and qualified dividends. Examples of suitable filers include single individuals with a full-time job or married couples who earn salaries without extensive financial complexities.

Understanding Exemptions for IRS 1040-A

Exemptions may apply to certain taxpayers based on specific criteria. Here are qualifying conditions for exemptions:

01

Gross income below the maximum threshold ($100,000 for 2023).

02

Individuals aged 65 or older may qualify for an additional exemption.

03

Taxpayers with qualified dependents can also claim exemptions.

04

Income derived exclusively from specific sources such as wages or retirement income.

Filing Deadline for IRS 1040-A

The typical deadline for submitting IRS 1040-A is April 15th of each year. For 2023 filings, this deadline will be extended to April 18th due to the weekend and the Emancipation Day holiday in Washington, D.C. Mark your calendars to avoid late penalties!

Comparing IRS 1040-A with Other Tax Forms

It's important to differentiate IRS 1040-A from other tax forms, such as 1040-EZ and 1040. The 1040-EZ is a simpler form for those with a straightforward financial profile, whereas the 1040 allows for itemized deductions. Unlike the 1040, IRS 1040-A permits certain adjustments but not the complexity of extensive income types.

Transactions Covered by IRS 1040-A

The IRS 1040-A primarily covers basic income types such as:

01

Wages from employment reported on Form W-2.

02

Interest income from banks and financial institutions.

03

Qualified dividends from corporate stock.

04

Retirement distributions from pensions and IRAs.

Required Copies for Submission

Typically, only one copy of the IRS 1040-A is necessary for submission. However, retain additional copies for your records, and consider keeping a digital version for easy access in the future.

Penalties for Non-Submission of IRS 1040-A

Failing to file the IRS 1040-A on time can lead to significant penalties, including:

01

A failure-to-file penalty of 5% of unpaid taxes for each month delayed, with a maximum of 25%.

02

Interest accrued on any unpaid tax amount, compounding daily.

03

Legal repercussions, including IRS audits for repeated non-compliance.

Information Required for Filing IRS 1040-A

When preparing to file, gather the following information:

01

Social Security numbers for yourself, your spouse, and any dependents.

02

Income records, such as W-2 forms and 1099 statements.

03

Records of any tax-deductible expenses or above-the-line deductions.

04

Bank account information for direct deposit or payment arrangements.

Additional Forms Needed with IRS 1040-A

While IRS 1040-A may be filed independently, multiple forms can accompany it, including:

01

Schedule A for itemized deductions, if filing circumstances change.

02

Form 8862 for those claiming the Earned Income Credit after disqualification.

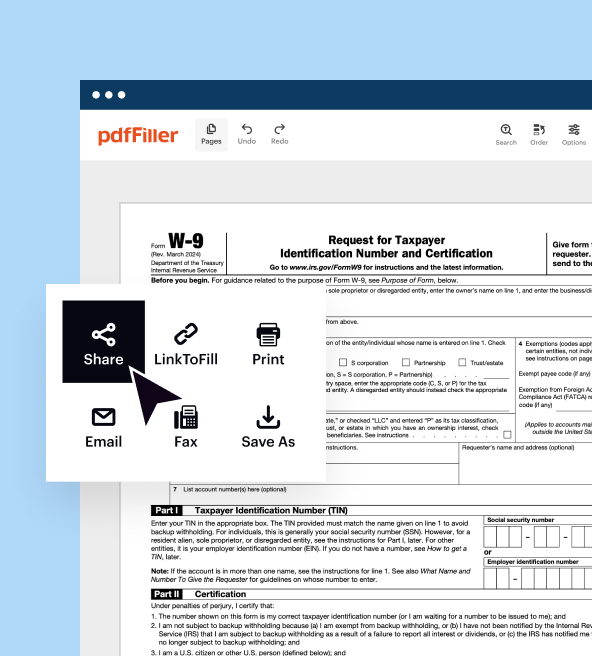

Where to Submit Your IRS 1040-A

Submit your completed IRS 1040-A via mail to the address specified in the filing instructions based on your residency state. Consider filing electronically for faster processing and confirmation.

Understanding and efficiently filling out the IRS 1040-A can simplify your tax filing and ensure compliance. Don’t hesitate to reach out to tax professionals or utilize tax software for assistance, ensuring your form is completed correctly and submitted on time. Take the stress out of tax season and start mastering your tax responsibilities today!

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.